georgia ad valorem tax trade in

Currently the ad valorem tax formula that applies to your vehicle depends on. If I itemize deductions on Federal Schedule A can I deduct my auto registration and.

Comparing Taxes As A Percentage Of Sugar Sweetened Beverage Prices In Latin America And The Caribbean The Lancet Regional Health Americas

Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax These taxes are replaced by a one-time tax called the title ad.

. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan. If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County. Friday May 20 2022.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA. The Ad Valorem Tax or the Property Tax is based on value. A The term sales price applies.

Georgia ad valorem tax trade in. The trade-in value of another motor vehicle will be deducted from the value to get the taxable value. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the.

This calculator can estimate the tax due when you buy a vehicle. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to. Use Ad Valorem Tax Calculator.

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Cars Purchased On or After March 1 2013. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from the sales and use tax and the annual ad valorem.

What if I think that the title ad valorem tax assigned to my vehicle is too high. Georgia technically does not charge sales tax on the purchase of new and used vehicles. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit.

Everyone who owns a vehicle licensed in Georgia must pay ad valorem tax at the time of purchase. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the.

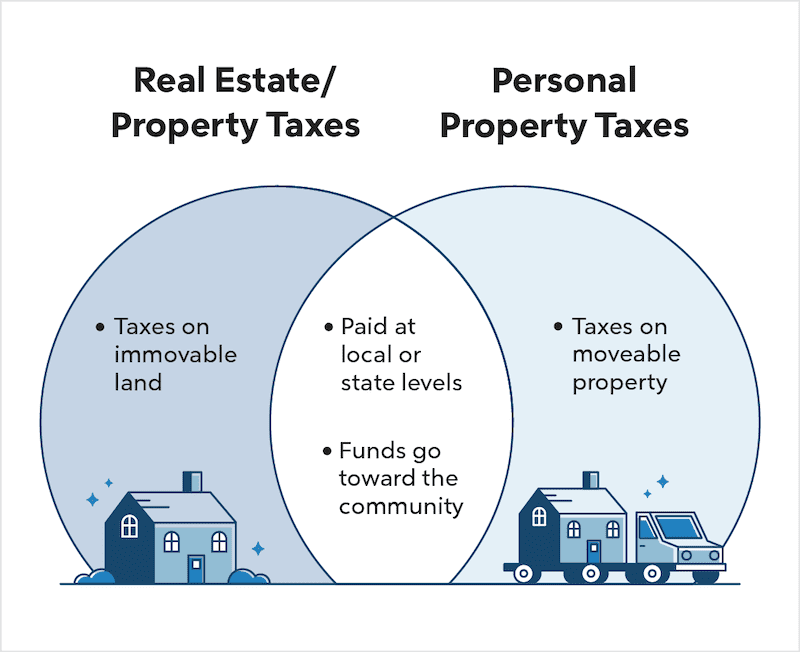

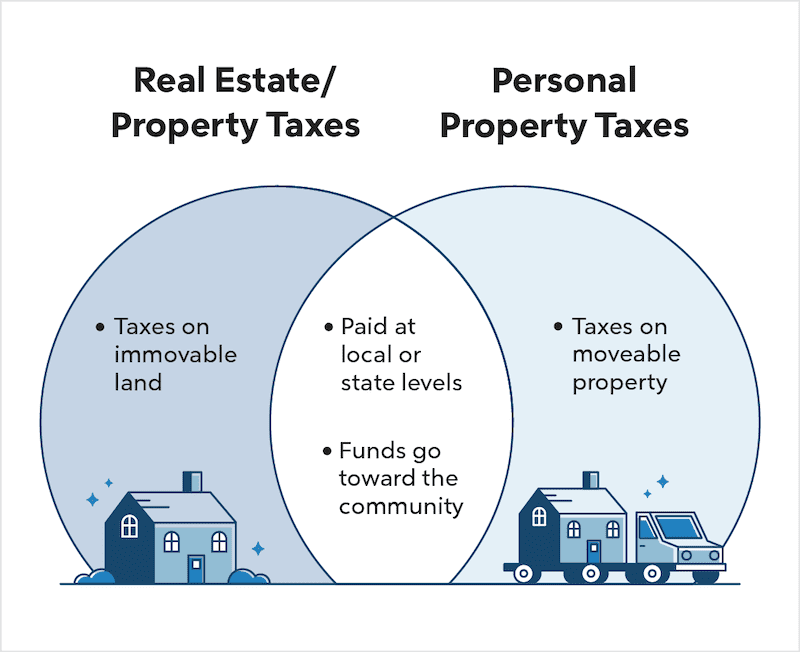

Real Estate Taxes Vs Property Taxes Quicken Loans

Property Taxes Property Tax Analysis Tax Foundation

Lanthanides Chemistry Learner In 2022 Electron Configuration Element Symbols Curie Temperature

Understanding Taxes And Your Home Property Tax Tax Consulting Tax

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Check Me Out On Cnn Com Cnn Money E Trade Terms Of Service

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Taxes Property Tax Analysis Tax Foundation

Georgia Used Car Sales Tax Fees

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples

Visit Asean 50 Tourism Branding Unveiled Http Goo Gl Pbseqc Travel Marketing Campaign Logo Tourism

Distribution Of Kudzu In The United States Invasive Species Species Charts And Graphs

Accounting Taxation Legal Digital Marketing Business Consultant E Filing And E Solutions Digital Marketing Seo Digital Marketing Corporate Law